The Effect of The Financial Crisis and Basel III on Risk Disclosure In Banks Financial Reports - A Textual Analysis

Abstract

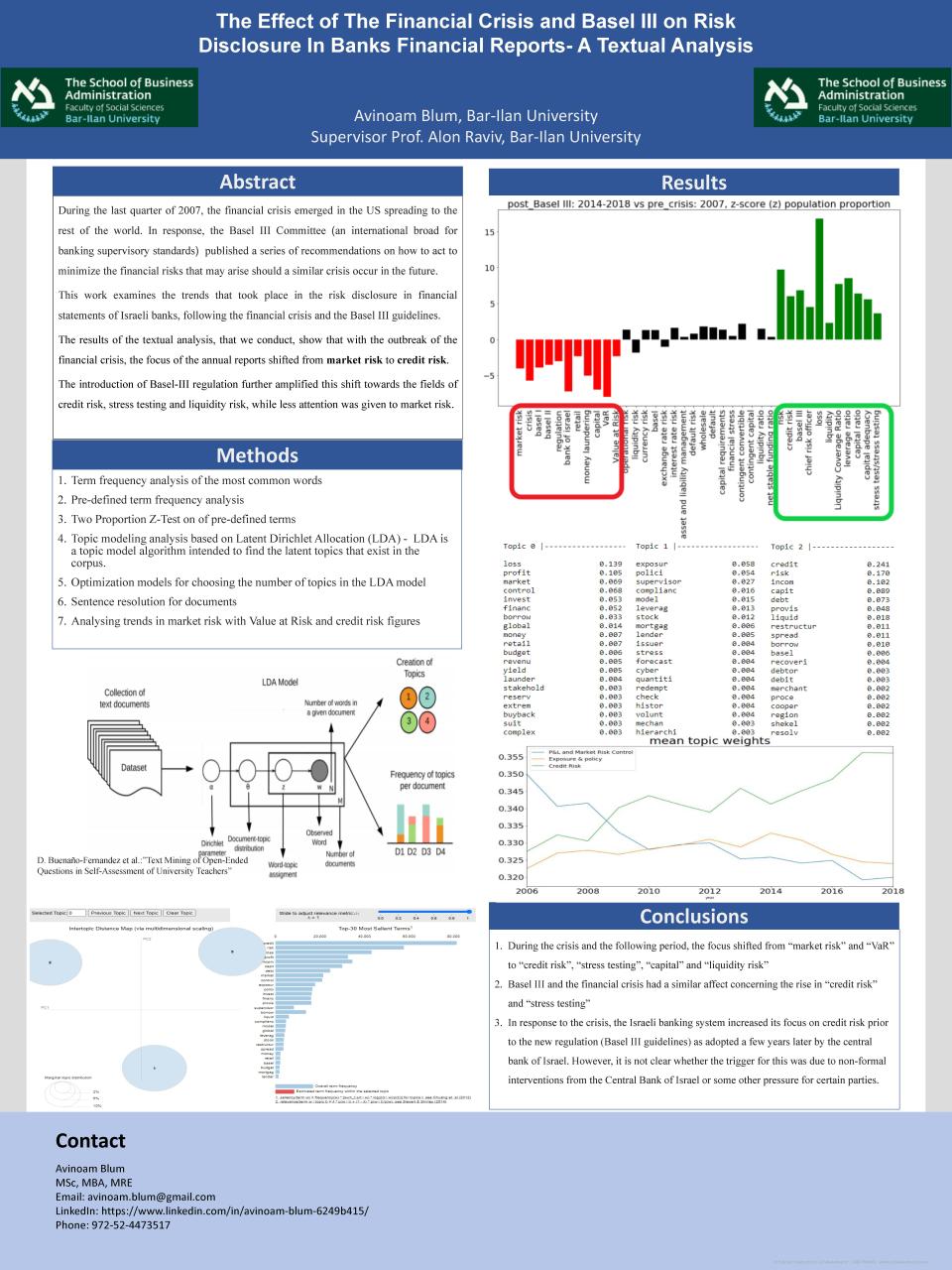

During the last quarter of 2007, the financial crisis emerged in the US spreading to the rest of the world.

In response, the Basel III Committee ( an international broad for banking supervisory standards) published a series of recommendations on how to act tominimize the financial risks that may arise should a similar crisis occur in the future.

This work examines the trends that took place in the risk disclosure in financial statements of Israeli banks, following the financial crisis and the Basel III guidelines.

The results of the textual analysis, that we conduct, show that with the outbreak of the financial crisis, the focus of the annual reports shifted from market risk to credit risk.

The introduction of Basel-III regulation further amplified this shift towards the fields of credit risk, stress testing and liquidity risk, while less attention was given to market risk.

..